Introduction:

Sending email campaigns and utilizing email marketing flows are not the only benefits you can derive from Klaviyo. One crucial metric that can help you achieve your goals is Customer Lifetime Value (CLV). Klaviyo plays a pivotal role in comprehending and harnessing the power of CLV to drive sustainable growth.

In this article, you’ll gain a complete understanding of important terms related to CLV. Let’s dive in!

The difference between CLV and LTV:

The world of marketing can be filled with confusing acronyms, and sometimes it’s hard to find out which ones you should be using for your business. To add to the confusion, some acronyms mean the same thing and are used interchangeably, like CLV and LTV.

If you’ve ever come across articles talking about lifetime value (LTV), customer lifetime value (CLV), or lifetime customer value (LCV), don’t worry—all are of the same meaning. Stay calm : )

Here, I’ll use the CLV term throughout the article.

1] Predicted CLV:

It’s a guess that how much a 1 time customer can spend on your brand in the future based on predictive analytics and forecasting. You can

check predicted CLV by following the following steps:

- Go to ‘Profile section’ from klaviyo left side options

- Navigate to your any customer profile

- Click on ‘Metrics and Insights’ next to details tab

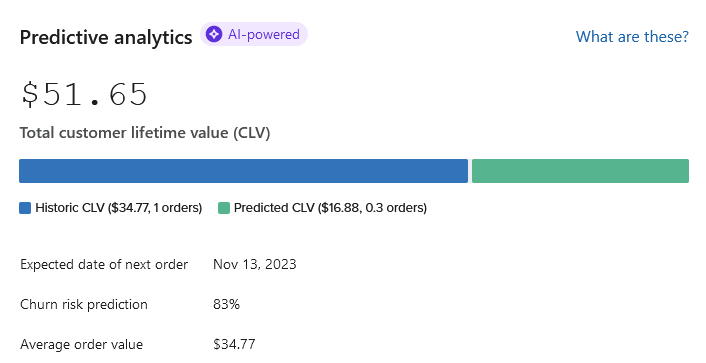

- Go to ‘Predictive Analytics’ section

Remember! You cannot see this section for non-buyers.

- From there, check out ‘Predicted CLV’ and it’s $16.88

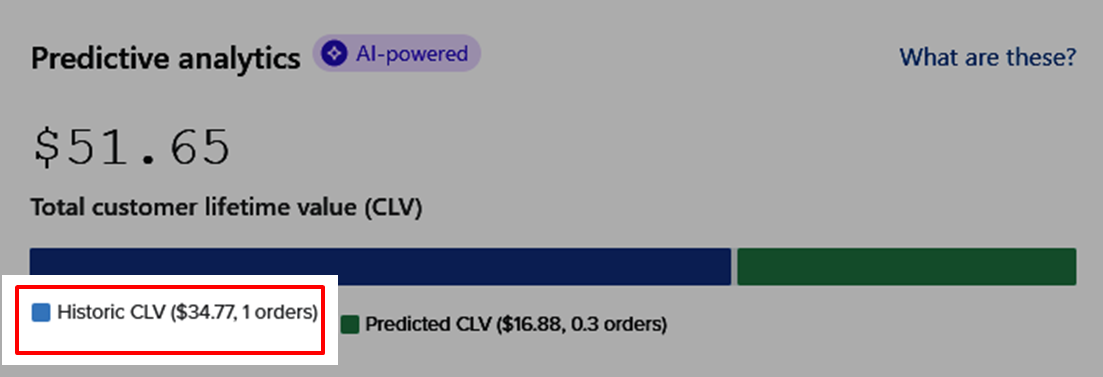

2] Historic CLV:

Historic CLV refers to the total amount a customer has spent at your store. If any customer purchased for the first time worth $70 so, his historic CLV would be $70.

From the above screenshot, you can find historic CLV and that’s $34.44.

3] Total CLV (Customer Lifetime Value):

Total Customer Lifetime Value (Total CLV) represents the complete value a customer contributes to a business throughout their entire relationship with that business. It encompasses both the historical spending, which is the sum of all the money they have spent in the past, and the predicted future spending, which estimates how much they are likely to spend in the future.

In mathematical terms:

Historic CLV (the sum of past spending) + Predicted CLV (the estimated future spending) = Total CLV

For example, based on the information provided in the screenshot, the Total CLV is calculated as $34.77 (Historic CLV) + $16.88 (Predicted CLV) = $51.65

4] Low Historic CLV:

Referring to customers who have spent a relatively small amount at your store.

To determine a low historic CLV value, you should establish what constitutes high CLV, low CLV, and medium CLV for your business.

For instance, you might define low historic CLV as $50-60, medium CLV as $65-80, and high CLV as $81-100

5]Low Predicted CLV:

Refers to customers who are expected to purchase again, but they will spend a little amount. Like it can be below $50.

You can find customers with low predicted CLV through segmentation in klaviyo.

6] High Historic CLV:

High Historic CLV refers to customers who, based on historical data, have demonstrated a higher lifetime value to the business. For example, any customer who has made a purchase worth $81-100 might be considered to have high historic CLV.

Through segmentation, you can also find customers with high historic CLV and can offer them discount as they are expected to sped a significant amount.

7] High Predicted CLV:

High Predicted CLV refers to customers who are predicted to have a higher future lifetime value based on predictive models. For example, a customer who has made one purchase and is likely to make another with a spending above $80 can be marked as having a high predicted CLV.

Hope you loved this article ‘Complete understanding of important terms related to CLV’.

Wanna take your E-commerce business to next level with proven email marketing strategies? You’re just ONE step away. DM ‘Klaviyo consultation’ at info@alixemail.com or click here to schedule a meeting”

Don’t forget to subscribe our YouTube channel [Marketing Chamber ] for klaviyo tutorials. For Urdu/Hindi klaviyo tutorials click here. For English klaviyo tutorials click here.

FAQs:

1] What is Customer Lifetime Value (CLV)?

Answer: CLV is a metric that calculates the total revenue a business can expect from a customer over their entire relationship with that business.

2] Why is CLV important?

Answer: CLV helps businesses understand the long-term value of their customers, guide marketing strategies, and allocate resources effectively.

3] How do you calculate CLV?

Answer: You can find out CLV using the following formula:

Average purchase value * the average purchase frequency * average customer lifespan.

4] What’s the difference between Historic CLV and Predicted CLV?

Answer: Historic CLV is based on past customer behavior, while Predicted CLV uses predictive analytics to estimate future customer value.

6] What are some CLV segmentation strategies?

Answer: Segment customers based on CLV into groups like high, medium, and low CLV, then tailor marketing efforts accordingly.

7] What role does email marketing play in CLV?

Answer: Email marketing can nurture customer relationships, provide product recommendations, and encourage repeat purchases, all of which can increase CLV.

8] How can I use CLV to set marketing budgets?

Answer: CLV helps you determine how much you can spend to acquire new customers while still maintaining profitability.

9] What are the concepts of CLV?